Table of Contents

1. Introduction to FinOps and Shifting Left

Accelerate Innovation by Shifting Left FinOps, Part 2

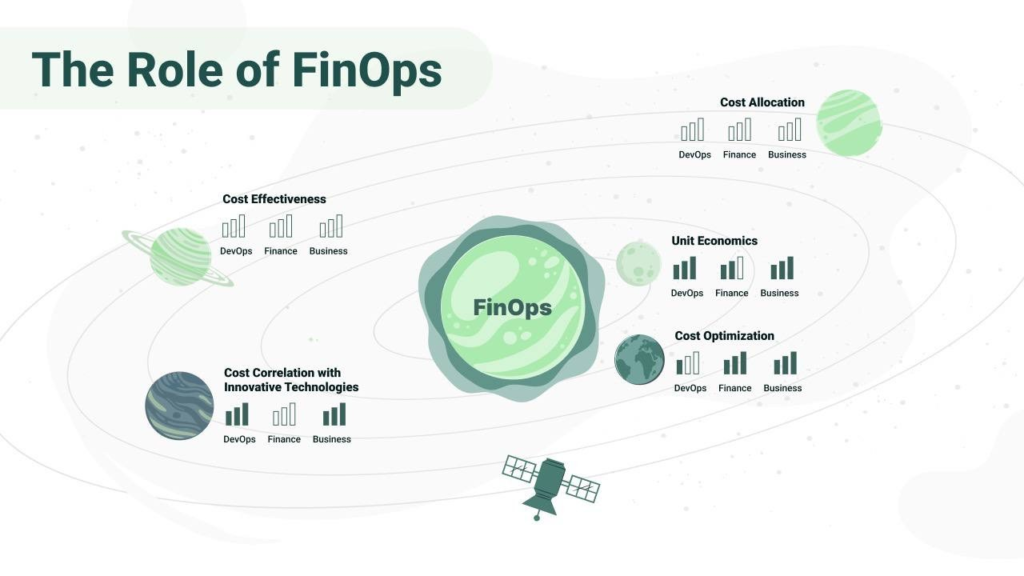

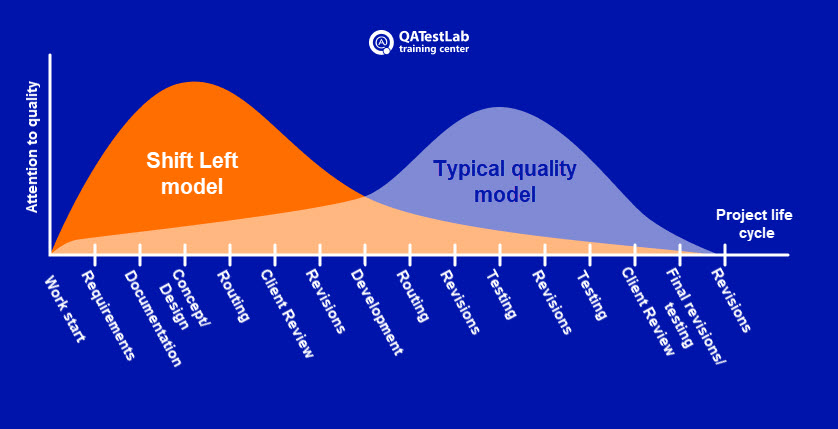

FinOps, short for Financial Operations, represents a significant shift in how companies manage their cloud expenditures and financial processes. As organizations increasingly rely on cloud services, the need to align finance with technology and operations has become more crucial. Shifting Left, a concept borrowed from software development, involves moving certain responsibilities and decision-making processes earlier in the development lifecycle. In the context of FinOps, Shifting Left means integrating financial considerations into the early stages of product development, ensuring that cost-efficiency and budget alignment are not afterthoughts but integral components of the development process. “Accelerate Innovation by Shifting Left FinOps, Part 2”

This approach is crucial for fostering innovation, as it allows teams to make informed decisions early on, reducing the risk of cost overruns and enabling faster time-to-market. By integrating financial insights into the early phases of development, companies can optimize their resources, avoid expensive rework, and ensure that their innovations are both technically feasible and financially sustainable. “Accelerate Innovation by Shifting Left FinOps, Part 2”

2. Recap of Part 1

In Part 1, we explored the foundational concepts of FinOps and the initial steps to implement a Shifting Left approach. We discussed the importance of aligning financial operations with cloud-native technologies and the need for a proactive stance in financial management. The key takeaways included the significance of early financial planning, the integration of FinOps into agile workflows, and the impact of real-time financial insights on decision-making. “Accelerate Innovation by Shifting Left FinOps, Part 2”

These principles laid the groundwork for a more detailed exploration of how Shifting Left can accelerate innovation, which we will delve into in this article. By building on these concepts, organizations can move towards a more integrated and efficient approach to financial operations, driving innovation and competitive advantage. “Accelerate Innovation by Shifting Left FinOps, Part 2”

3. Challenges in Traditional FinOps Approaches

Traditional FinOps approaches often struggle with several challenges that hinder innovation. One of the primary issues is the delay in financial decision-making, which can lead to missed opportunities and inefficient resource allocation. Financial decisions are typically made at the end of the development cycle, resulting in misalignment between the technical and financial aspects of projects. This disconnect often leads to cost overruns, as financial constraints are not considered during the initial planning stages. “Accelerate Innovation by Shifting Left FinOps, Part 2”

Moreover, the lack of real-time financial insights means that teams are often unaware of the cost implications of their decisions until it is too late. This reactive approach can stifle innovation, as teams are forced to operate within rigid financial constraints that do not account for the dynamic nature of technology development. “Accelerate Innovation by Shifting Left FinOps, Part 2”

4. The Role of Shifting Left in FinOps

Shifting Left in FinOps addresses these challenges by moving financial considerations to the forefront of the development process. By incorporating financial management early on, organizations can identify potential cost drivers before they become problematic. This proactive approach allows for more accurate budgeting and resource allocation, enabling teams to innovate within a clear financial framework. “Accelerate Innovation by Shifting Left FinOps, Part 2”

Additionally, Shifting Left facilitates real-time financial insights, which are crucial for making informed decisions throughout the development lifecycle. By integrating financial data with operational and development tools, teams can continuously monitor and adjust their strategies to ensure both technical and financial alignment. This real-time feedback loop is essential for maintaining agility and driving innovation in fast-paced environments. “Accelerate Innovation by Shifting Left FinOps, Part 2”

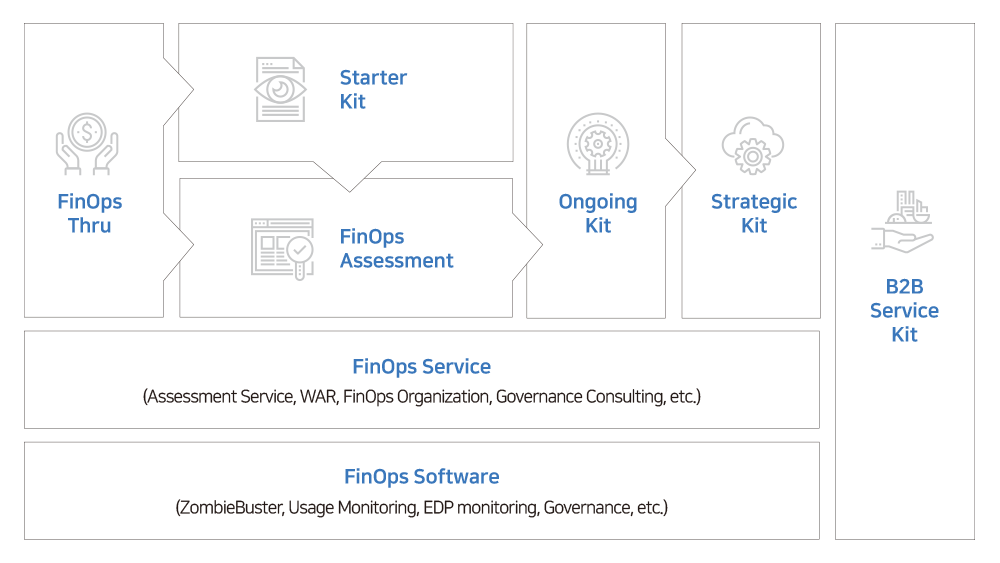

5. Tools and Technologies for Shifting Left FinOps

The successful implementation of Shifting Left in FinOps relies heavily on the use of advanced tools and technologies. Automation is a key component, as it enables the seamless integration of financial data into development workflows. Tools like CI/CD (Continuous Integration/Continuous Deployment) pipelines can be enhanced with financial metrics, allowing for automated cost tracking and budgeting. “Accelerate Innovation by Shifting Left FinOps, Part 2”

AI and machine learning technologies also play a crucial role in Shifting Left FinOps. These tools can analyze vast amounts of data to identify trends, predict future costs, and provide actionable insights. For example, machine learning algorithms can forecast cloud spending based on usage patterns, enabling teams to adjust their strategies proactively. “Accelerate Innovation by Shifting Left FinOps, Part 2”

Moreover, the integration of financial management tools with existing development platforms ensures that financial considerations are embedded into every stage of the development process. This integration helps teams maintain a continuous focus on cost-efficiency without sacrificing innovation. “Accelerate Innovation by Shifting Left FinOps, Part 2”

6. Case Studies: Successful Shifting Left FinOps

Several organizations have successfully adopted Shifting Left FinOps, leading to significant improvements in their innovation processes. For example, a leading tech company integrated FinOps into their agile development framework, resulting in a 30% reduction in cloud spending and a 20% faster time-to-market for new products. By involving finance teams early in the development process, they were able to align their budget with their technical goals, avoiding costly rework and enabling more efficient use of resources. “Accelerate Innovation by Shifting Left FinOps, Part 2”

Another case study involves a financial services company that implemented AI-driven FinOps tools to predict and manage cloud costs. This proactive approach allowed them to optimize their cloud resources, leading to a 25% increase in operational efficiency and a 15% reduction in time spent on financial management tasks. These examples demonstrate the tangible benefits of Shifting Left in FinOps and highlight the potential for organizations to accelerate innovation through this approach. “Accelerate Innovation by Shifting Left FinOps, Part 2”

7. Implementation Strategies for Shifting Left FinOps

Implementing Shifting Left in FinOps requires a strategic approach that involves several key steps. First, it is essential to align finance teams with development teams early in the process. This can be achieved through regular cross-functional meetings and the establishment of shared goals and metrics. By fostering collaboration between finance and development, organizations can ensure that financial considerations are embedded into every stage of the development process.

Continuous monitoring and feedback loops are also critical for successful implementation. By integrating financial data into development tools and processes, teams can receive real-time insights and adjust their strategies accordingly. This continuous feedback loop helps maintain alignment between financial and technical objectives, ensuring that projects stay on track and within budget.

Finally, organizations should consider adopting a phased approach to implementation. Starting with small pilot projects allows teams to experiment with Shifting Left FinOps and refine their processes before scaling up. This gradual approach helps mitigate risks and ensures a smoother transition to a fully integrated FinOps model.

8. Aligning Culture with Shifting Left FinOps

A successful shift to Left FinOps requires not just new tools and processes, but also a cultural shift within the organization. This involves changing mindsets across teams to embrace a more collaborative and transparent approach to financial management. Encouraging open communication between finance, operations, and development teams is essential for fostering a culture of collaboration.

Building a culture of transparency and accountability is also crucial. Teams should be encouraged to share financial insights and challenges openly, creating a more informed and engaged workforce. This cultural alignment helps ensure that financial considerations are integrated into the decision-making process at all levels of the organization, driving more informed and innovative outcomes.

9. Training and Skill Development for FinOps Teams

To effectively implement Shifting Left FinOps, organizations must invest in training and skill development for their teams. This includes providing finance teams with the technical skills necessary to collaborate with development teams, such as understanding cloud computing, software development methodologies, and data analysis tools.

Training programs should also focus on the specific tools and technologies used in Shifting Left FinOps, such as automation platforms, AI, and machine learning. By equipping teams with the skills needed to leverage these tools, organizations can ensure that they are well-prepared to implement and manage Shifting Left FinOps effectively.

Additionally, organizations should consider providing ongoing professional development opportunities to keep teams up-to-date with the latest trends and best practices in FinOps. This continuous learning approach helps maintain a high level of expertise within the organization, enabling teams to adapt to changing technologies and market conditions.

10. Overcoming Resistance to Shifting Left FinOps

Implementing Shifting Left FinOps can be met with resistance, particularly from teams that are accustomed to traditional ways of working. Common challenges include skepticism about the benefits of Shifting Left, concerns about increased workload, and fear of losing control over financial decisions.

To overcome this resistance, it is important to communicate the benefits of Shifting Left FinOps clearly and consistently. This can be done through case studies, pilot projects, and regular updates on the progress and impact of Shifting Left initiatives. Gaining executive buy-in is also crucial, as leadership support can help drive the cultural and operational changes needed to implement Shifting Left successfully.

Additionally, organizations should address concerns about workload by streamlining processes and providing adequate resources and support. By demonstrating the positive impact of Shifting Left on innovation and efficiency, organizations can gradually reduce resistance and build support for this approach.

11. Measuring the Impact of Shifting Left FinOps

To assess the effectiveness of Shifting Left FinOps, organizations need to establish clear metrics and key performance indicators (KPIs). These metrics should focus on both financial and operational outcomes, such as cost savings, time-to-market, and resource utilization.

Tools for tracking financial performance in real-time are essential for measuring the impact of Shifting Left FinOps. These tools allow organizations to monitor costs, budget adherence, and return on investment (ROI) continuously. By analyzing these metrics, organizations can identify areas for improvement and make data-driven decisions to optimize their FinOps practices.

Case studies showing the impact of Shifting Left can also provide valuable insights into the effectiveness of this approach. By comparing the performance of projects before and after implementing Shifting Left FinOps, organizations can demonstrate the tangible benefits of this approach and build a compelling case for its continued use.

12. Future Trends in Shifting Left FinOps

The future of Shifting Left FinOps is likely to be shaped by several emerging trends, including the increasing use of predictive analytics and forecasting. These technologies can help organizations anticipate future costs and adjust their strategies accordingly, enabling more proactive financial management.

The evolution of FinOps roles is another trend to watch. As FinOps becomes more integrated with development and operations, the role of finance professionals is likely to expand to include more technical responsibilities. This shift will require finance teams to develop new skills and expertise, further blurring the lines between finance and technology.

Finally, the future of FinOps in agile environments will likely involve greater automation and the use of AI-driven tools. These technologies can streamline financial management processes, enabling organizations to maintain agility while ensuring financial alignment. As these trends continue to evolve, organizations that embrace Shifting Left FinOps will be well-positioned to drive innovation and maintain a competitive edge.

13. Best Practices for Long-Term Success

For organizations to achieve long-term success with Shifting Left FinOps, continuous improvement is key. This involves regularly reviewing and optimizing FinOps practices to keep pace with technological advancements and changing market conditions. Regular audits and optimizations can help organizations identify areas for improvement and ensure that their FinOps practices remain effective and aligned with their goals.

Keeping up with technological advancements is also crucial for long-term success. As new tools and technologies emerge, organizations should be prepared to adopt and integrate them into their FinOps practices. This proactive approach helps ensure that organizations remain at the forefront of innovation and can continue to drive efficient and cost-effective outcomes.

Finally, organizations should focus on building a culture of continuous learning and improvement. By fostering an environment where teams are encouraged to experiment, learn from their experiences, and share their insights, organizations can ensure that their FinOps practices remain dynamic and responsive to changing needs.

14. Frequently Asked Questions (FAQs)

- What is Shifting Left in FinOps? Shifting Left in FinOps involves integrating financial management into the early stages of the development process to ensure cost-efficiency and budget alignment throughout the project lifecycle.

- How does Shifting Left benefit FinOps? Shifting Left enables proactive financial management, early identification of cost drivers, and real-time financial insights, leading to more informed decision-making and faster time-to-market.

- What tools are needed for Shifting Left FinOps? Tools such as automation platforms, CI/CD pipelines integrated with financial metrics, and AI-driven analytics are essential for implementing Shifting Left FinOps effectively.

- How can I get started with Shifting Left FinOps? Begin by aligning finance and development teams early in the process, implementing automation tools, and fostering a culture of collaboration and transparency across teams.

- What are the common challenges in Shifting Left FinOps? Common challenges include resistance to change, the complexity of integrating financial tools with development processes, and the need for upskilling finance teams to work with new technologies.

- How do I measure success in Shifting Left FinOps? Success can be measured using metrics such as cost savings, time-to-market, budget adherence, and return on investment, supported by real-time financial tracking tools.

15. Conclusion

In conclusion, Shifting Left in FinOps represents a powerful strategy for accelerating innovation while maintaining financial discipline. By integrating financial considerations into the early stages of development, organizations can optimize resources, reduce costs, and bring products to market faster. As technology and market conditions continue to evolve, adopting a Shifting Left approach in FinOps will be essential for organizations seeking to stay competitive and drive continuous innovation.

MegaFamous TechCommand: Revolutionizing the Future of Technology